Engineering private equity data ecosystems since 2017

Deal Engine structures and enriches your firm’s data to scale insights throughout the deal lifecycle

Enabling firms to create their own edge

161

actionable insights per firm per month, on average

64

new deals on the radar in 2 months, on average

45M+

market datapoints accumulated in typical client data warehouse

99.5%

efficiency gain versus manual company research

Connecting the unconnected in dealmaking

Unifying the data, intelligence, and signals that exist for private equity firms, and transforming it into deals

Integrations/Data Partners Section

Natively integrated with 30+ systems

Deal Engine connects with the platforms you already use, streamlining data movement, mapping, and enrichment.

Why every private equity firm needs a data engine

Private equity is primed for the next competitive frontier, and our latest guide explores how firms use data engines to win

Our data engineering process

Initial platform configuration

We deploy your platform, connect core systems, audit your CRM universe, and deliver live market monitoring to the firm

Layer in your investment thesis

The ability to configure sectors, regions, scoring logic, and key signals combined with embedded RSS and third-party data hooks expands your firm’s monitored universe quickly.

Configuration to your workflows

Our process enables thoughtful integration with institutional systems, custom-tuned to how your firm operates, especially how it discovers and evaluates deals

Tune-up and operationalization

Optimize connectors, deploy custom models, roll out firmwide, update data feeds, and finalize recommendations, becoming fully operational

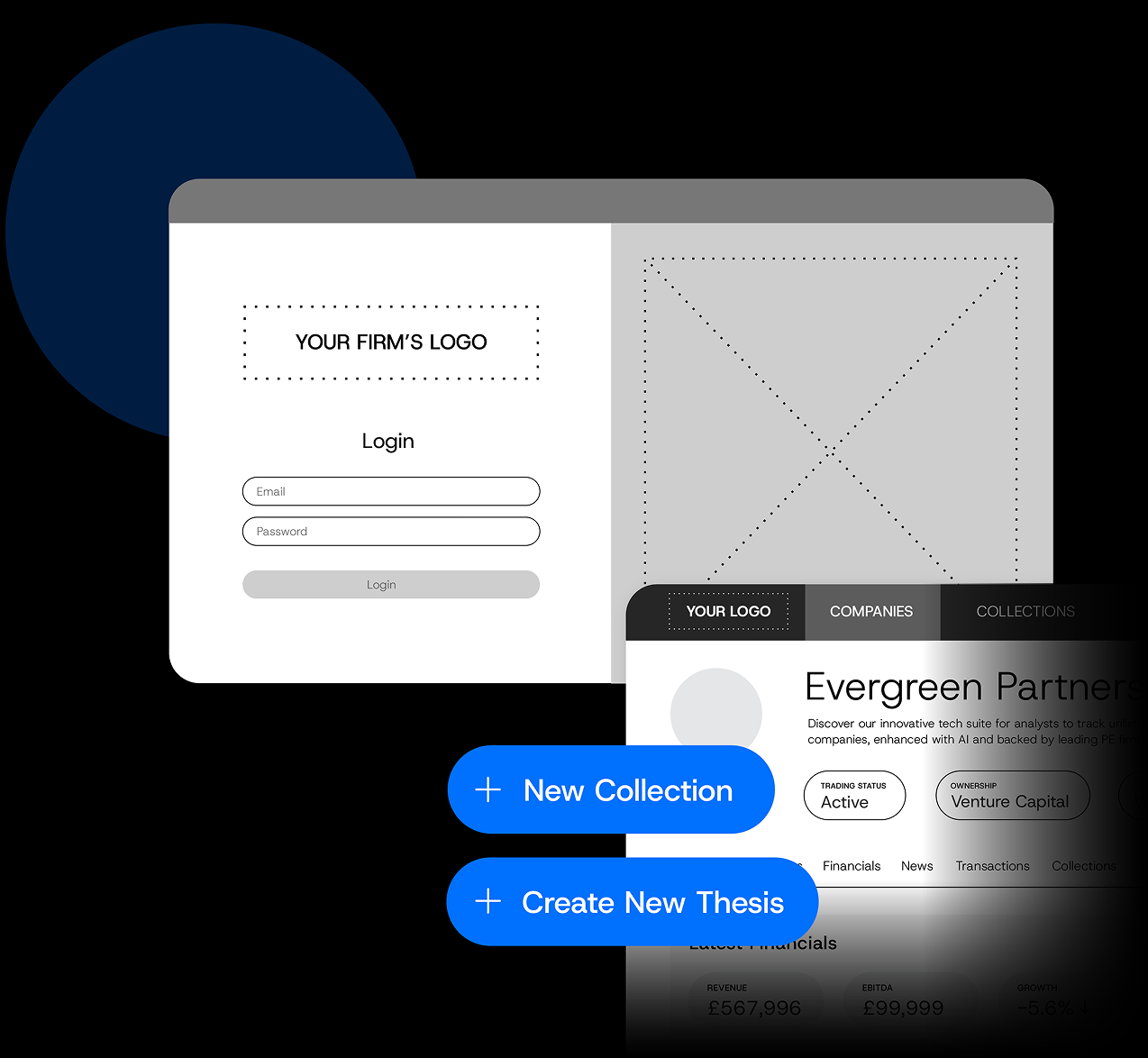

Give your data engine a name

White-label the platform, name it, and train it as your own internal asset, building stewardship, encouraging adoption, and the feel of a home-grown intelligence engine

Private equity's best kept secret

Deploy a fully white-labeled data engine your firm can name, customize, and train as if it were built in-house.

What private equity pros are saying

Automate everyday tasks

"Banker list review, score and assessment used to take 1 day. Now it takes 2 minutes. "

Accelerate the AI roadmap

"Deal Engine gave us a leap forward in our commitment to building a proprietary edge and integrating advanced technology into our dealmaking"

A data engine you can trust

"Now the deal team has our firm's integrated 'walled garden' of knowledge at their fingertips"

Engineer your competitive edge

"The firms that win are codifying their strategy into in-house AI assets and making that a big part of the culture."

Data engineering and deal sourcing AI for private equity

Deal Engine is a white-labelled, deployed software platform that generates continuous deal velocity, 24/7

AI for PE, from origination to value creation

Empower origination teams with codified scoring, net-new recommendations, watchlists and tracked deals.

Be first to every deal.

See Deal Engine in action.

Discover how Deal Engine is providing private equity firms with the data engineering and AI capabilities fueling their competitive advantage.