Fueling your firm's AI roadmap

Deal Engine powers your data engineering architecture for AI-enhanced dealmaking, purpose-built for private equity.

Our Clients

The firm's data ecosystem, in one intelligent engine

Integrate all internal and external data sources into a living, learning data engine built for private equity.

Helping tech leadership get data in the fast lane

Our purpose-built data engine pulls together your entire market and proprietary data ecosystem, fueling your AI roadmap.

AI for PE, from origination to value creation

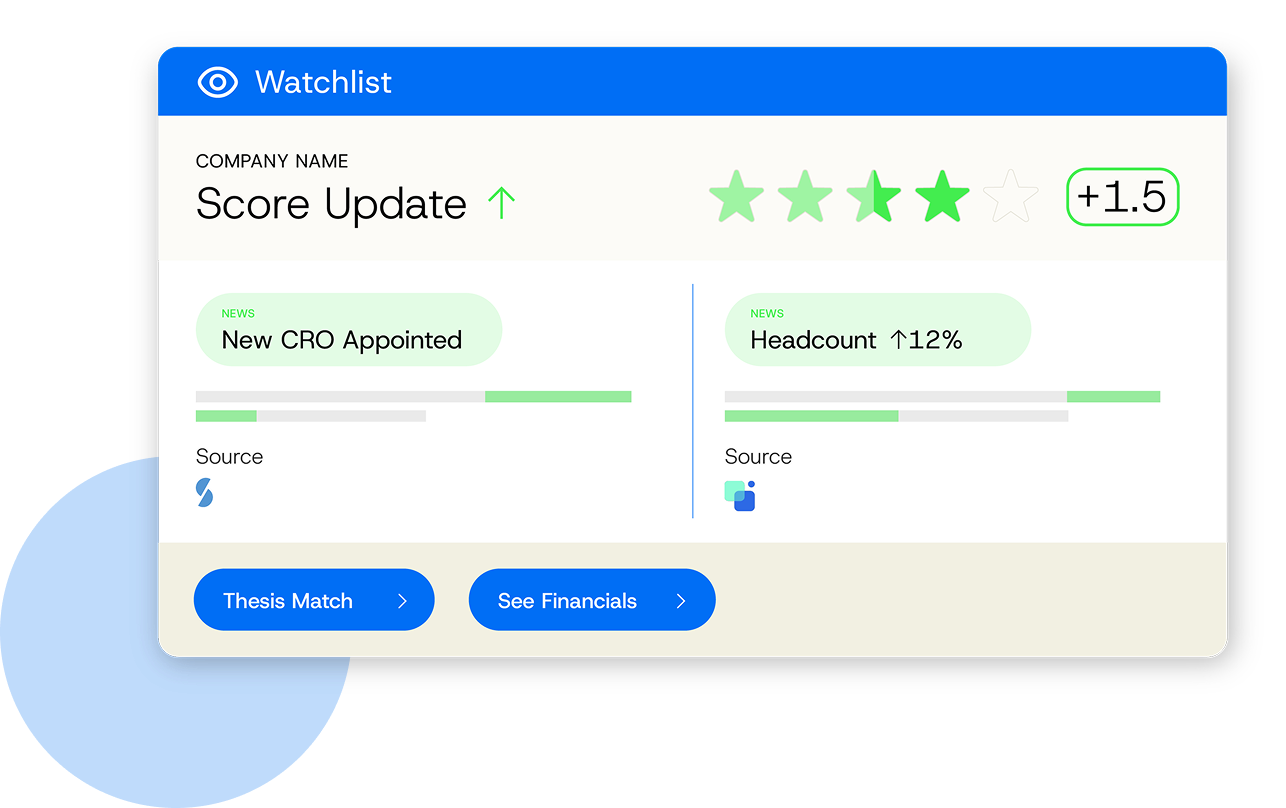

Empower origination teams with codified scoring, net-new recommendations, watchlists and tracked deals.

Connecting the unconnected in dealmaking

Unifying the data, intelligence, and signals that exist for private equity firms, and transforming it into deals.

Finally, a platform your firm can truly customize

Deal Engine is offered as a white-labelled solution, resulting in faster onboarding, adoption, brand alignment and organizational buy-in.

Expand the firm's funnel

Deal Engine delivers always-on intelligence that continuously monitors your entire investable universe — specified by your thesis — and surfaces high-fit targets.

Unify data, unlock insights

Deal Engine brings together proprietary, third-party, and public data into a single connected layer, transforming information into actionable intelligence.

Power up instead of piling on

Deal Engine enriches your CRM with structured, intelligent data without adding clutter, complimenting your existing tech stack instead of complicating it.

Build the AI-enabled firm of tomorrow

Accumulate and train your firm’s own proprietary data engine, built to evolve with your strategy and scale firm-wide tech-readiness.

Enabling firms to create their own edge

45M+

datapoints accumulated in a typical deployment

161

actionable insights per firm per month, on average

64

new deals on the radar in 2 months, on average

99.5%

decreased analyst time spent on manual research

Resources

Private equity’s tech mandate is clear

Private equity’s tech mandate is clear: Run faster, build smarter, and choose AI partners carefully

How modern data engines are changing the rules of private equity

How modern data engines are changing the rules of private equity Private equity and corporate finance have spent the last decade layering on CRMs, datasets and dashboards, yet many teams still struggle to see a single, joined-up view of their market. In our recent data engines webinar, VP of Growth Alex Bajdechi noted that firms are now juggling “Expert network data, company data, fundraising data, proprietary data sitting across Excel data rooms” without a coherent way to connect it all.

AI in private equity predictions

From experiments to engines: predictions for AI in private equity in 2026 Private equity is entering 2026 with AI shifting from experimentation to expectation. The question is no longer whether to use AI, but how to make it a durable advantage across sourcing, underwriting, and value creation.

LLM as a data lake for private equity

The case against pointing an LLM at a data lake for private equity Across private equity, there’s a growing temptation to believe that modern AI can be reduced to a simple formula: load documents into a data lake like Snowflake, connect an LLM, and let the magic happen. But while that may be an appealing idea, it breaks down almost immediately in real-world PE environments - where data is complex, confidential, distributed, and deeply interwoven with firm-specific workflows.

Be first to every deal.

See Deal Engine in action.

Discover how Deal Engine is providing private equity firms with the data engineering and AI capabilities fueling their competitive advantage.